Warren Buffet recently made a strong pitch in favor of capitalism. This is a great motivation for many budding entrepreneurs. Though along the lines of pitching for capitalism, Buffett also mentioned that new age capitalism is quite different than what it used to be in the earlier decades.

What is New Age Capitalism?

New age capitalism refers to the e-commerce and digital startups that are coming up in huge numbers, these days. The two majorly observed characteristics of these new-age companies are

- They have an asset-light model. They do not believe in creating assets, rather they focus on leveraging existing business by enabling them with newer opportunities.

- The definition of what Investors called it as Economic Moat has changed. Previously economic moat meant strengthening business in a way that would reflect in the bottom line of the company. If you look at these new-age companies, most of them do not make any profits. Their target is to acquire as many customers as possible and enhance the overall enterprise value.

The new age economy is evolving with a long term objective. The present stage for them is, early-stage where the focus is on digitizing existing use cases and collecting data. This new age capitalism significantly differs in as compared to traditional way business. These businesses have led to a paradigm shift in how porters 5 forces work.

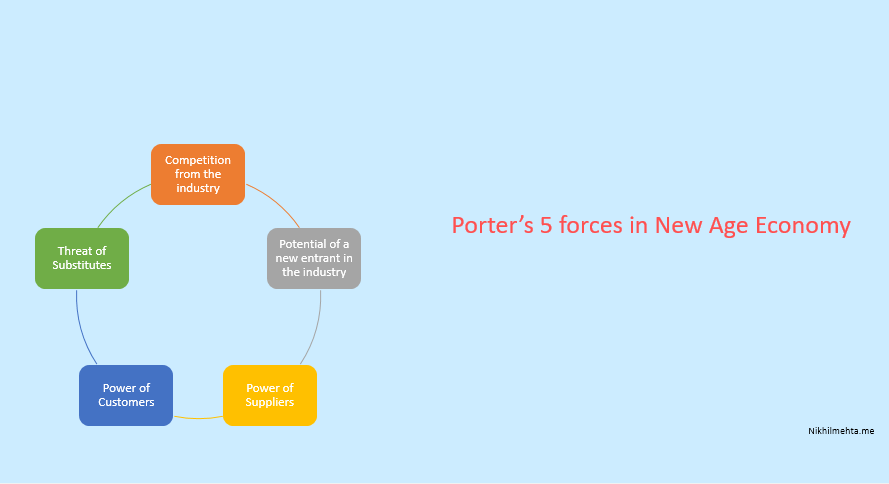

For the Uninitiated, Porter’s 5 forces are as follows.

- Competition from the industry

- Potential of a new entrant in the industry

- Power of Suppliers

- Bargaining Power of Customers

- Threat of Substitutes

Competition from Industry

In the decades gone by, there did not exist many aggregators. The market was a composition of smaller and large players. With aggregators entering the markets, competition has increased. With increasing competition and game of cash on hand, balance is tilting clearly towards the large players.

Potential of a new entrant in the industry

The potential of new entrant is at an all-time high, since making a website and digital tool is not difficult. Contrary to the age-old method of Licensing, nowadays starting a new business is relatively easy.

However, creating a wider supplier base in the huge market is not easy. The rush is towards forming a strong supplier network so it acts as a strong barrier of entry. Startups hence are pushing for funding to expand their base. e-Commerce marketplace is the game of economies of scale. The bigger your supplier base is, the higher would be the barrier of entry for a new entrant.

As per the book Value Investing by Bruce Greenwald, whenever there is a high enterprise value against EBIDTA of a company, there will be a rush of new initiatives in that space. High valuations despite making losses is one of the primary reasons we see so many entrepreneurs entering the digital businesses. Meaning that someday there will be heavy consolidation in the segment and most players would be acquired by their competitors or will be out of business. This acquisition by competition is the lucrative option sought after and hence you see so many new marketplaces with a similar business proposition.

Power of Supplier

When it comes to suppliers for these marketplaces, they can be broadly classified into two categories of large suppliers and small suppliers. Large suppliers are the ones that are big brands and can support the model of economies of scale. These suppliers would be selling the majority of the products on the marketplaces. Smaller suppliers, on the other hand, are the ones, which would send sell very few products. They do not have a high contribution to the model of economies of scale of marketplaces. Smaller suppliers did have a bargaining power since there were many distributors too. Now that the number of distributors has reduced, the bargaining power of small suppliers has diminished extensively.

Supplier forces of larger players are becoming stronger and smaller suppliers are becoming minority.

Bargaining Power of Customers

Previously, product information was not available on the fingertips. Customer behavior was restricted to visiting or calling a few shops and getting pricing details. The bargaining power of customers hence was not high. However, with the advent of digital technologies, customers now have all the information at their fingertips.

Customers in many markets like India have enjoyed the benefits of stiff competition. e-Commerce marketplaces offer deep discounting to lure customers to make purchases. Customers, however, will have good bargaining power till the time discounts are raining. Competition fading out is a far dream as of now. The lifetime value of the customer is accounted much higher over the traditional malls and Kirana shops.

Threat of Substitutes

This is one aspect that can not be quantified. However, with a combination of ease of access and increased disposable income shift is gradually happening from unbranded products to branded products. Aggregators influence user behavior heavily with discounts and cash-backs.

Inference

With new-age companies, we are seeing a paradigm shift in terms of how a business is done. Time will show if this method of doing business, despite making losses, is sustainable or not.

Also Read – Is the eCommerce future oversold in India?

References

https://www.cnbc.com/2019/04/08/american-billionaires-call-for-upgrades-to-capitalism-starting-with-higher-taxes-on-themselves.html

https://strategicmanagementinsight.com/tools/porters-five-forces.html